Employee Financial Wellness Report

Part 1: The Employer/Employee Divide on Financial Wellness

Click here to read the full report

Part 1 of the 2024 State of Employee Financial Wellness Report shines a light on the differences between employers’ and employees’ feelings towards benefits and which they each identify as most important and a fit for future investment, exposing a divide in views on financial wellness support.

The first part of the report also reveals a generational gap in financial stability and the importance of specific benefits.

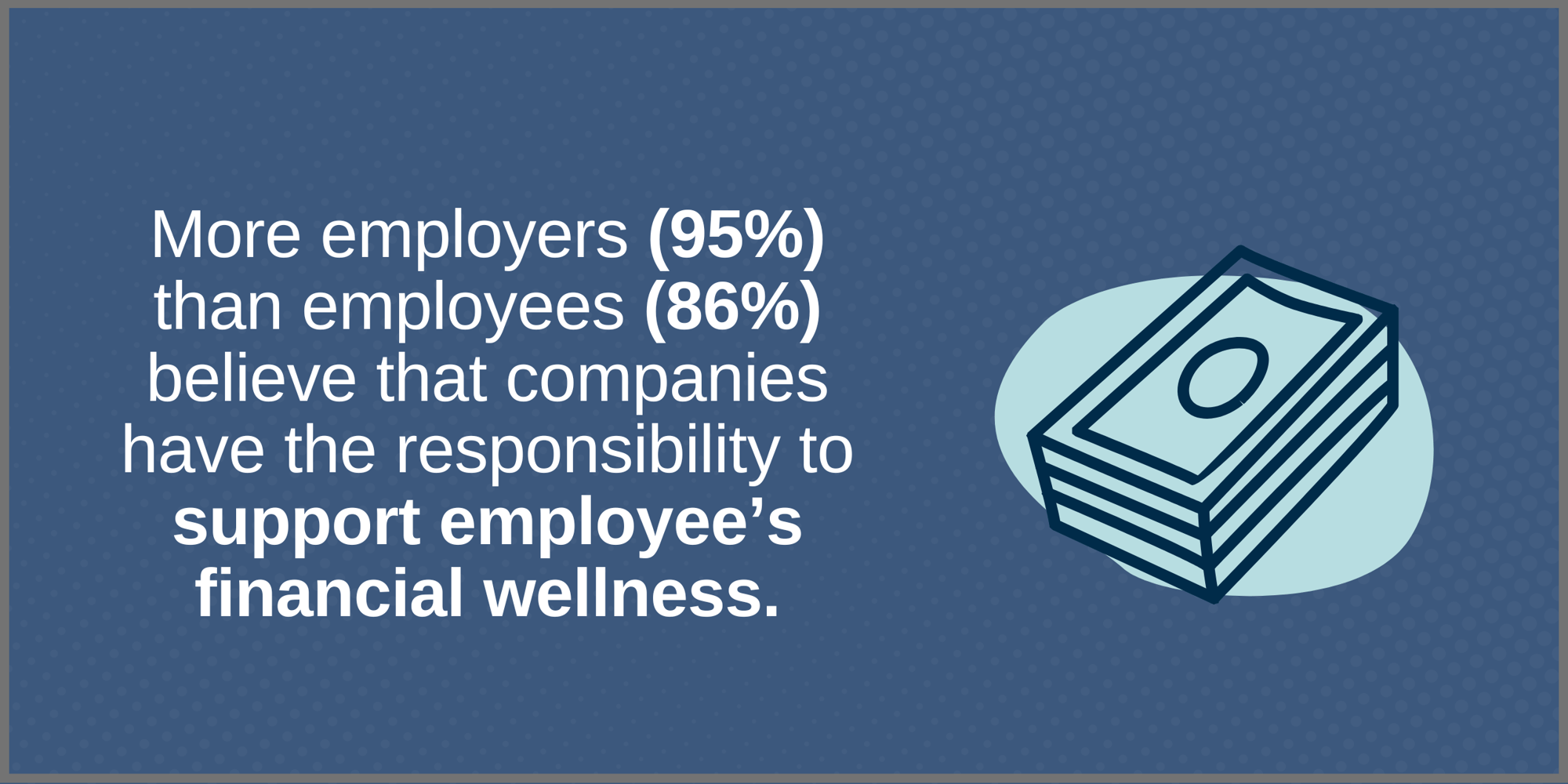

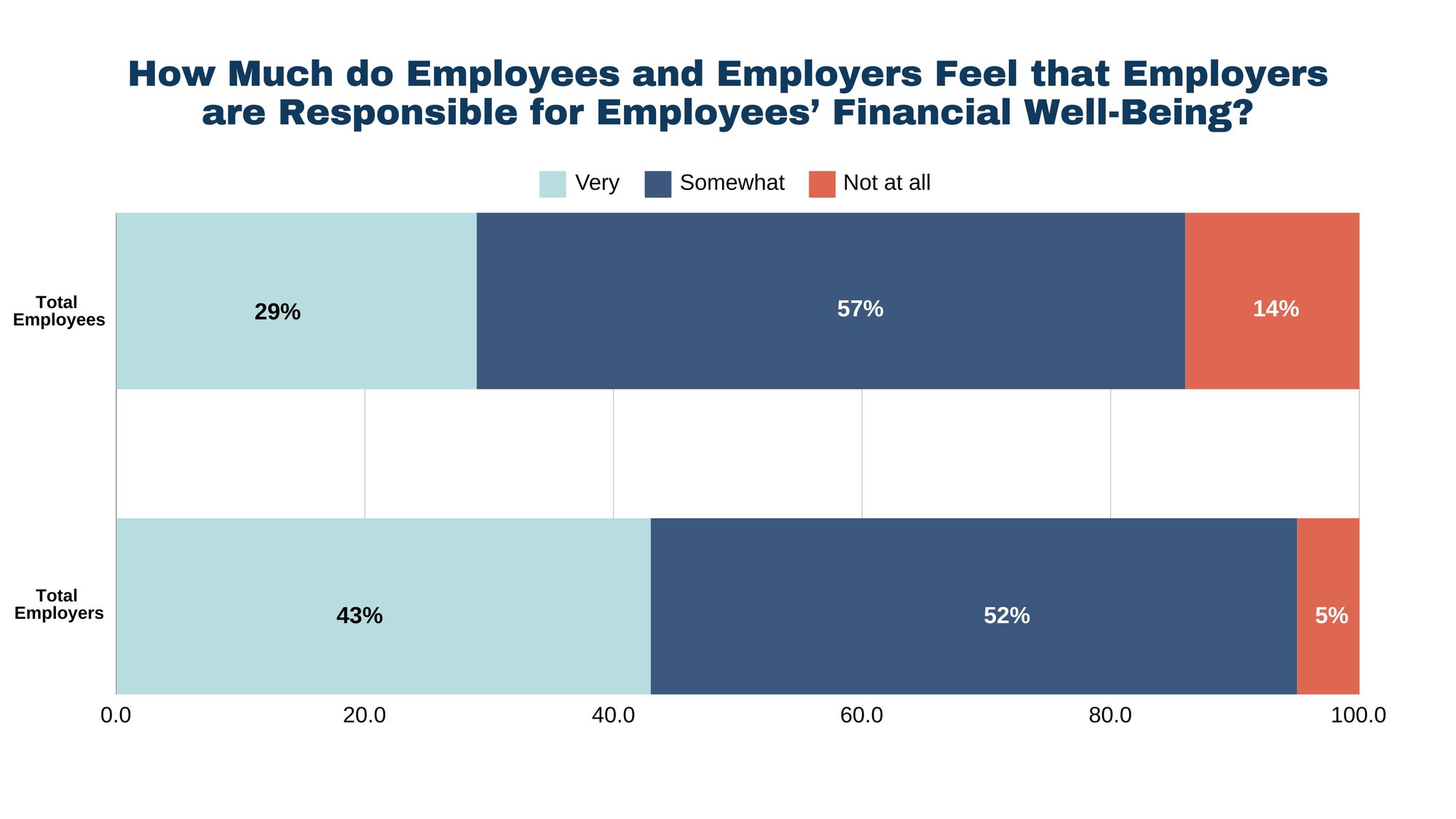

Finding: Employers feel more responsible for employees’ financial wellness than employees expect them to.

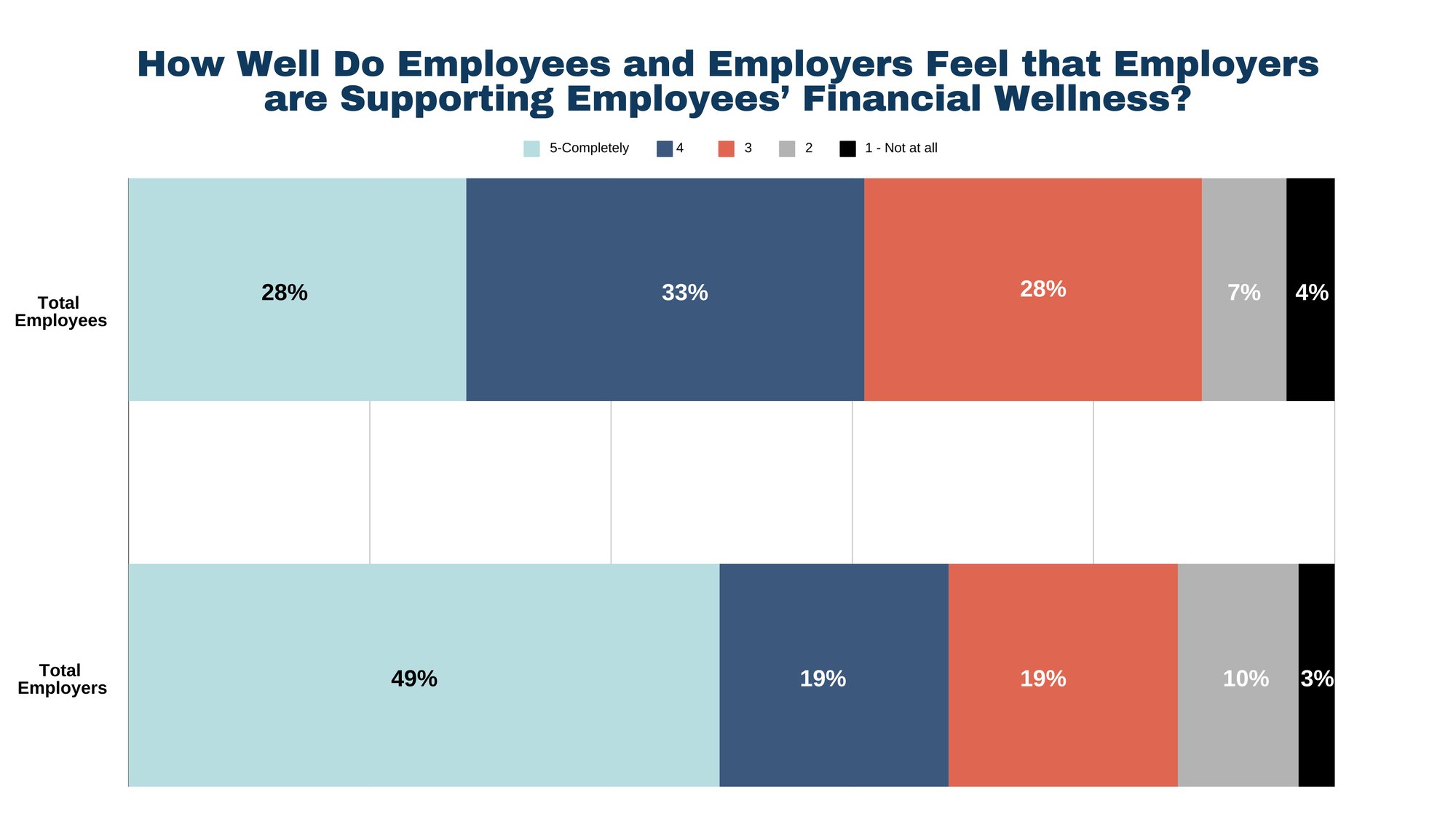

Finding: Employers believe they’re setting employees up for financial wellness –but a majority of employees disagree.

.png?width=1950&height=975&name=2024%20Employee%20Financial%20Wellness%20Report%20Insights%20-%202%20(1).png)

Additional Insight:

- Millennials feel the most supported by employers (43%) and Boomers feel the least (16%).

Finding: A majority of employees do not feel financially stable.

.png?width=2000&height=1000&name=2024%20Employee%20Financial%20Wellness%20Report%20Insights%20-%203%20(2).png)

.png?width=2000&height=1125&name=Dynata%20Survey%20Findings%20.pptx%20(13).png)

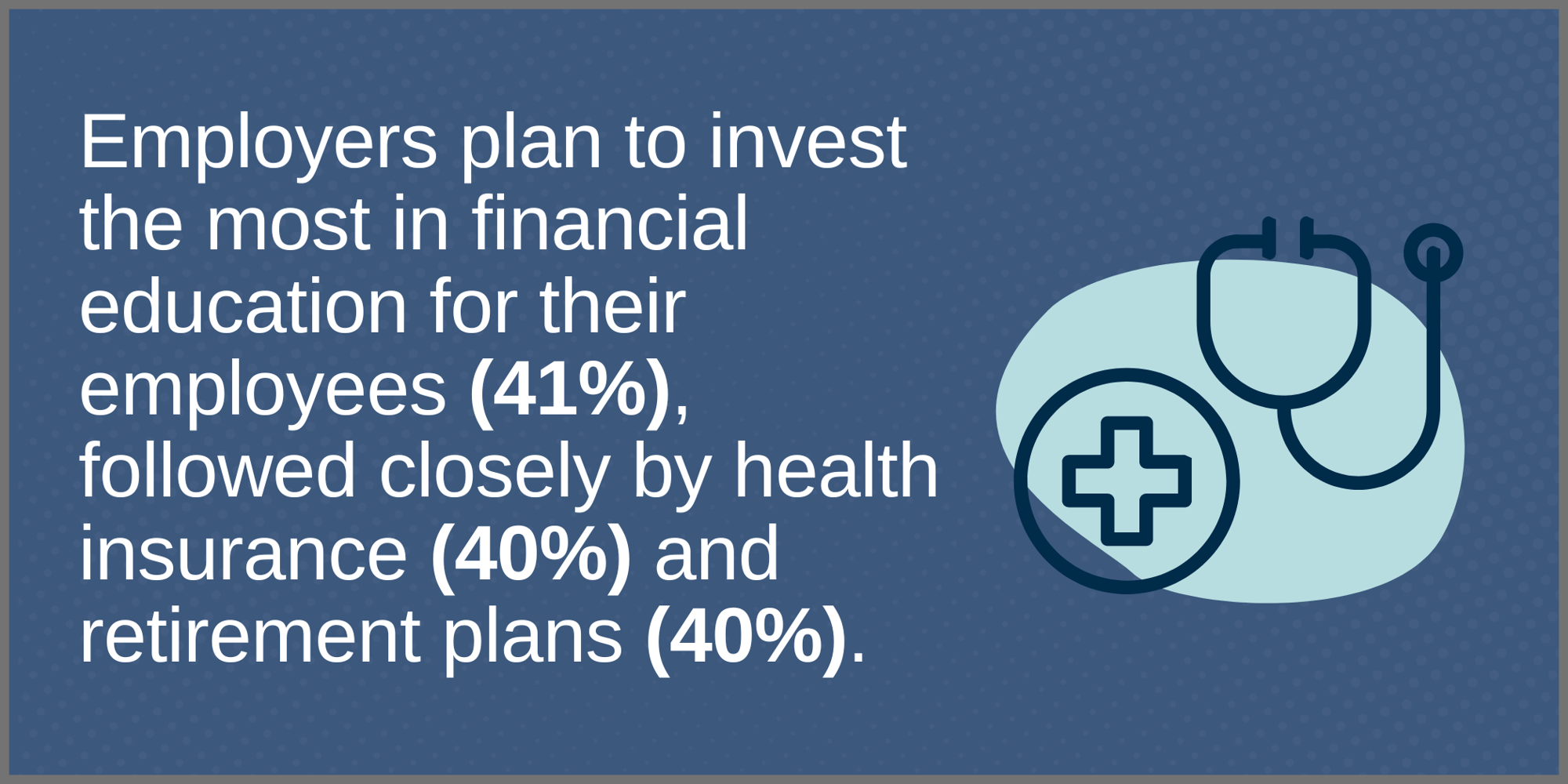

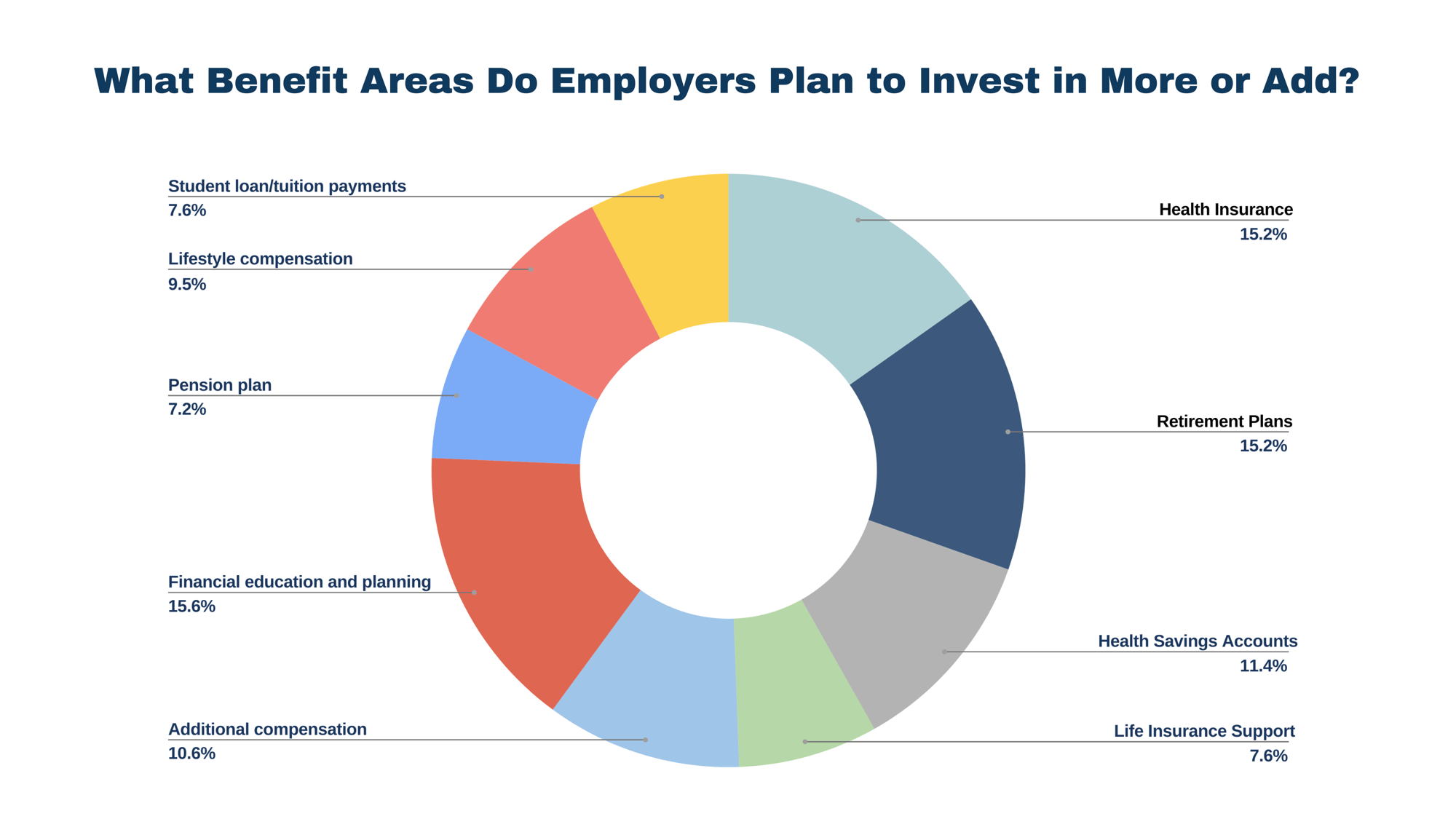

Finding: Employers are investing in benefits they find important – but they don’t align with employees’ priorities.

Additional Insights:

- While most employers expect to invest more (56%) or the same amount (39%) in financial wellness programs for employees, their investments don’t prioritize what employees find important.

- While health insurance (54%) and retirement plans (43%) are on the top of employees’ lists to have improved, only 12% of employees are interested in improved financial education and planning benefits.

Finding: Older generations prioritize healthcare and retirement benefits, while Gen Z employees want employers to prioritize lifestyle benefits.

Additional Insight:

- Forty-four percent (44%) of Boomers (ages 59+) say pensions are most important, 46% of Gen X + Y (ages 43-58) say additional compensation, 31% of Millennials (ages 27-42) say Health Savings Accounts (HSA/FSA) and 38% of Gen Z say lifestyle compensation (ages 18-26).

Finding: The benefits employers offer can make or break a prospective employee’s decision to take a job.

Additional Insight:

- Employers are aligned with these findings and consider retirement plans (80%) and health insurance (70%) as the most critical benefits to attracting and retaining employees.

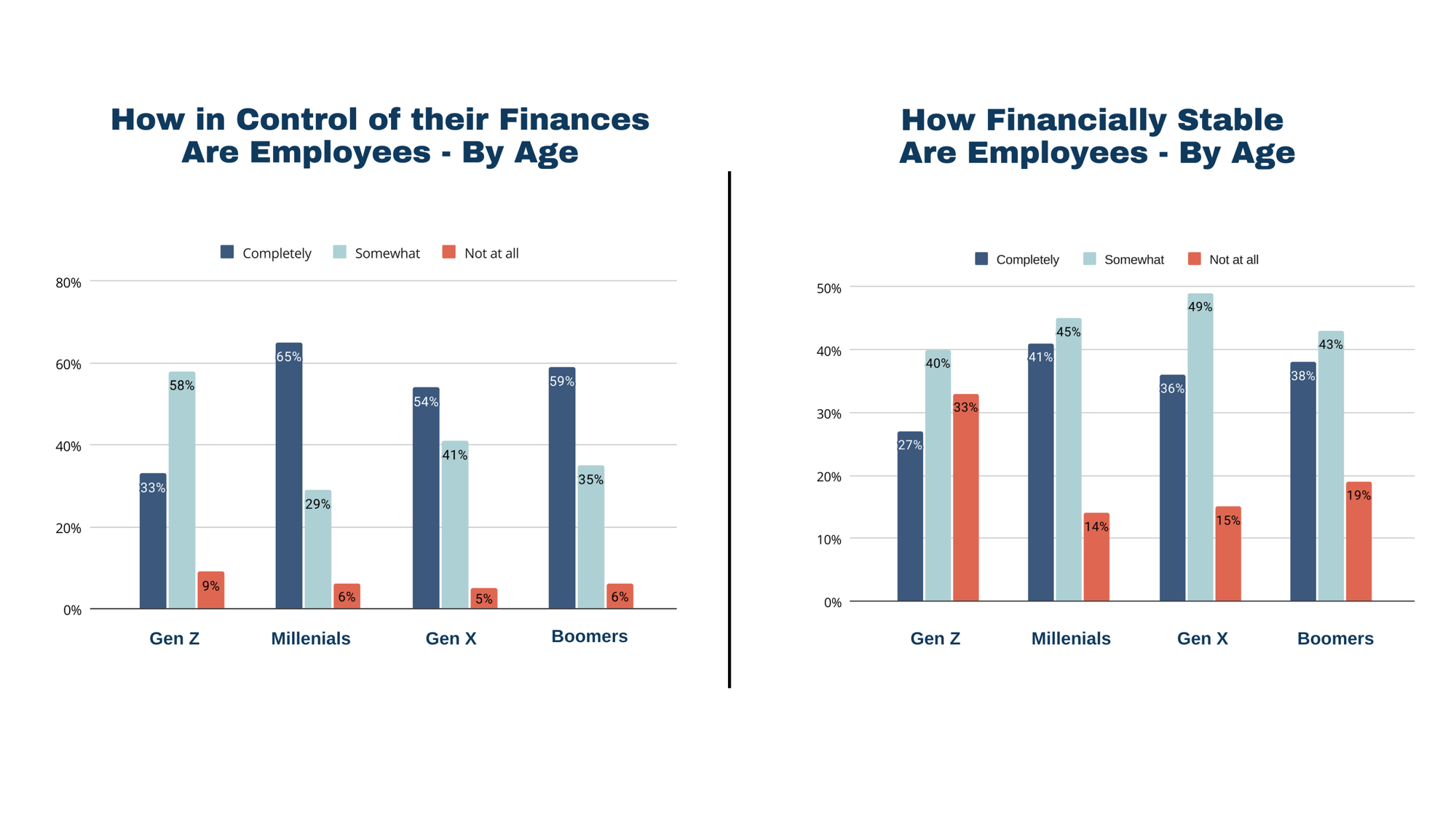

Finding: Millennials have the highest sense of financial well-being.

.png?width=1950&height=975&name=2024%20Employee%20Financial%20Wellness%20Report%20Insights%20-%206%20(1).png)

Additional Insights:

- 54% of Gen X and Y (ages 43-58), 38% of Boomers (ages 59+) and 33% of Gen Z workers (ages 18-26) say they are completely in control of their finances.

- Millennials also feel the most financially stable (41%), compared to Boomers (38%), Gen X and Y (36%) and Gen Z (27%).

- Gen Z has only been in the workforce for a few years, which is likely why they have the lowest confidence in their financial wellness.

Methodology

Payroll Integrations’ 2024 State of Employee Financial Wellness Report is based on research conducted by market research firm Dynata, on behalf of Payroll Integrations.

The report is based on responses from 250 full-time employees and company leaders responsible for payroll and benefits between the ages of 18 and 65.